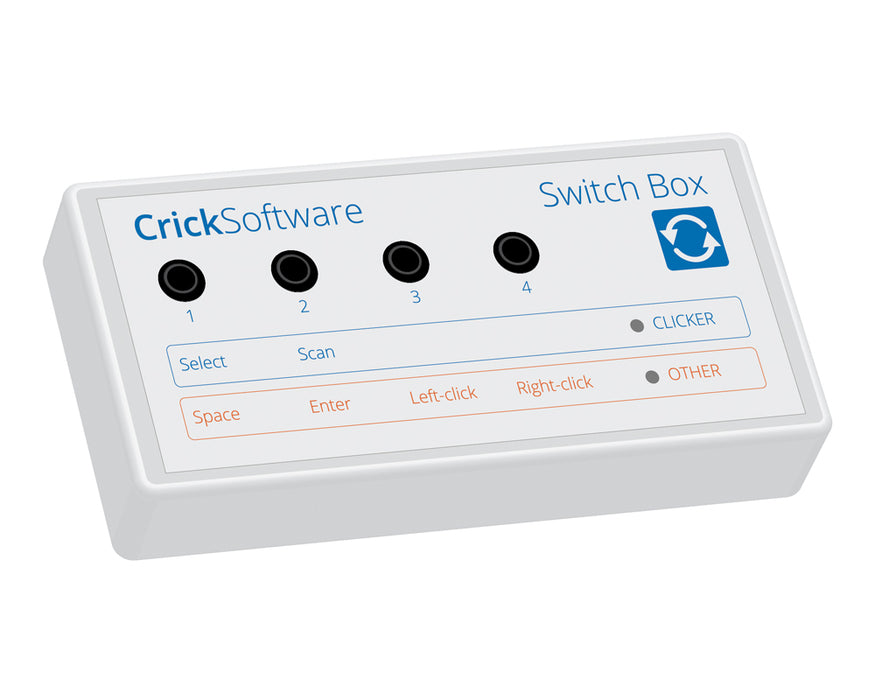

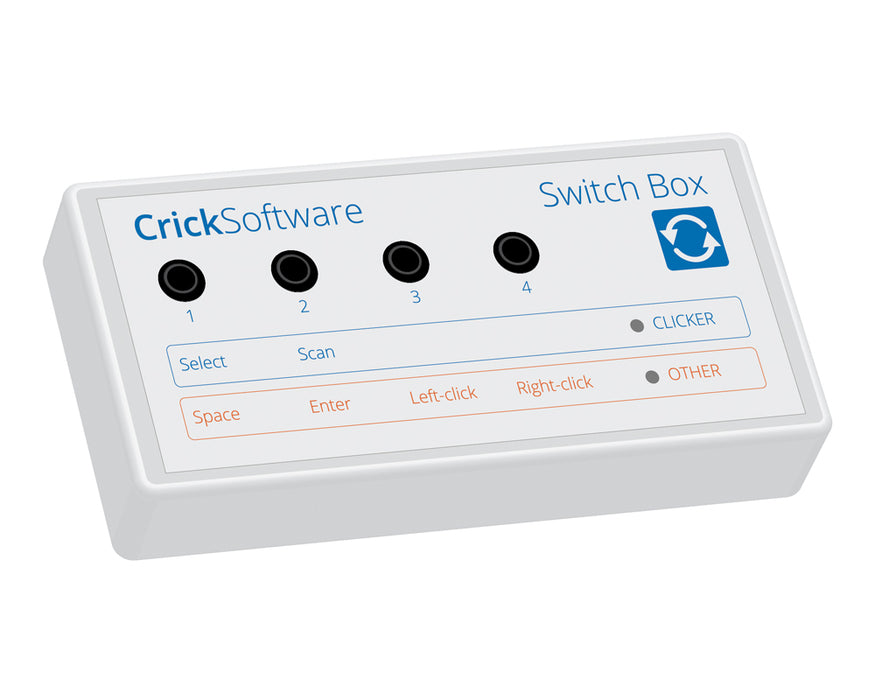

Crick USB Switch Box

Available for VAT relief

The Crick USB Switchbox is a dependable USB switch interface that provides smooth, instant access to a wide range of switch-accessible software on both Mac and PC.

Available for VAT relief

The Crick USB Switchbox is a dependable USB switch interface that provides smooth, instant access to a wide range of switch-accessible software on both Mac and PC.

Crick USB Switchbox: Easy-to-Use USB Switch Interface for Seamless Access to Switch Accessible Software

Designed for simplicity, the Crick USB Switchbox requires no setup for popular programmes such as Clicker—simply plug it in, and you’re ready to go.

Key Features:

The Crick USB Switchbox is ideal for users who need reliable, versatile switch access across various software applications, supporting education, communication, and interactive learning in accessible setups.

Some of the products in your order may be eligible for VAT Relief. See A Guide to VAT Relief for more details. If you do qualify for VAT Relief, please tick the relevant box below.

Please note: VAT Relief cannot be claimed by schools, other educational institutes, LEAs or companies - it is for private individuals and charities only.

Please note there are penalties for making false declarations

You (or the person for whom you are purchasing the products on behalf of) do not have to be registered disabled, but the nature of the illness or disablement must be specified below.

If you are in any doubt as to whether you are eligible to receive goods or services zero-rated for VAT you should consult Notice 701/7 VAT reliefs for disabled people or contact the National Advice Service on 0845 010 9000 before digitally signing the declaration.

By completing this form you authorise Inclusive Technology Ltd to hold your information on file. This data will be used for VAT accounting purposes only.

Please note there are penalties for making false declarations

You (or the person for whom you are purchasing the products on behalf of) do not have to be registered disabled, but the nature of the illness or disablement must be specified below.

If you are in any doubt as to whether you are eligible to receive goods or services zero-rated for VAT you should consult Notice 701/7 VAT reliefs for disabled people or contact the National Advice Service on 0845 010 9000 before digitally signing the declaration.